Nonprofit ratios are financial tools used to assess a nonprofit organization’s financial health. Think of them as magnifying glasses that show how well an organization manages its resources and how effectively it uses donations to achieve its goals. The numbers and percentages tell a story about the organization’s stability, efficiency, and transparency.

Imagine you are in a restaurant. You don’t just want to know that the food is good; you also want to know that the kitchen is clean, the ingredients are fresh, and the staff is well-trained. Nonprofit ratios do the same thing for organizations: they give you a big-picture view, ensuring everything is running as it should behind the scenes.

How do you use these ratios, and what do they measure? It’s pretty simple, even if it may seem complicated at first glance. Each ratio measures a different aspect of an organization’s finances. Some look at how well the organization manages its expenses, others at how financially stable it is over the long term, and others at how liquid it is, meaning how much immediate cash it has to cover its financial obligations.

These ratios are essential for anyone who wants to make an informed donation. You want to be sure that your money is being used in the best possible way. Nonprofit ratios help you understand whether an organization is trustworthy and well-run. For example, they tell you whether the organization spends most of its funds on programs and services rather than administrative or fundraising expenses. In other words, they show you whether your money is actually benefiting the cause you care about.

Another important aspect is sustainability. Will the organization be able to continue operating in the future? Nonprofit ratios give you an idea of how prepared the organization is to deal with unexpected financial contingencies. It’s like knowing whether you have enough savings to weather an unforeseen crisis. No one wants to donate to an organization that might close its doors tomorrow.

We live in a world where trust in organizations is crucial. People want to know that their donations are making a real difference and not ending up in a black hole of administrative expenses. Nonprofit reporting helps you see behind the scenes, understand what’s going on, and make informed decisions about where to put your money.

Understanding Financial Ratios for Nonprofits

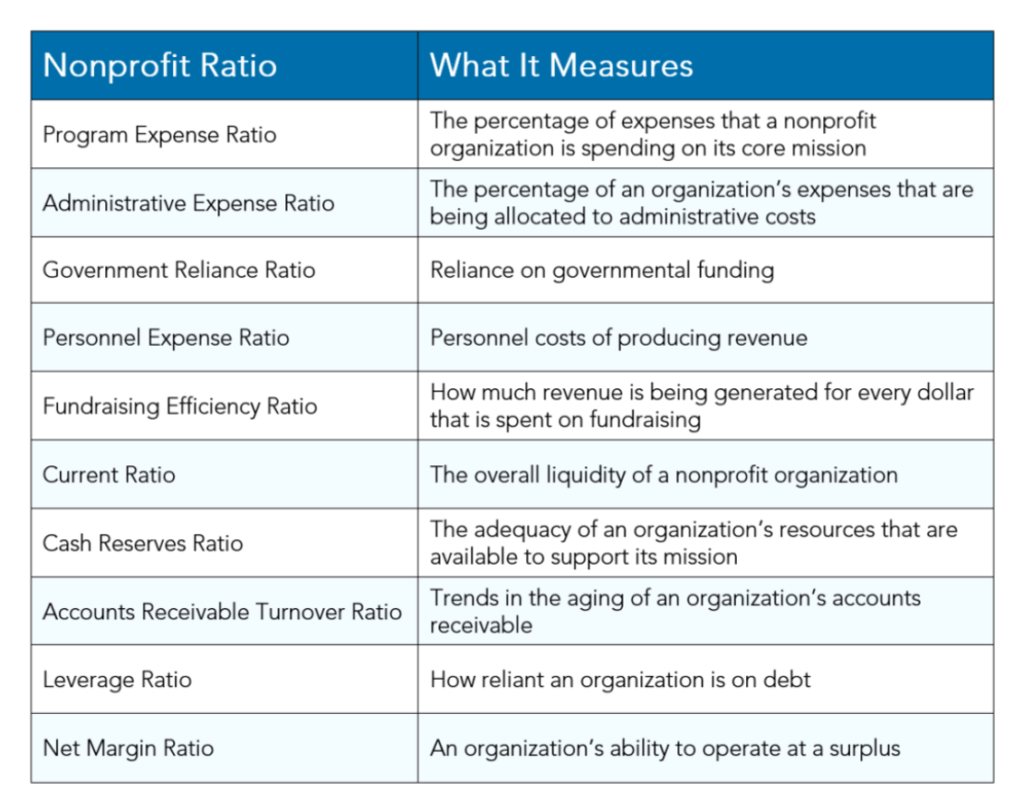

The most common financial ratios for nonprofits are:

- Program Expense Ratio

Program Expense Ratio = Program Services Expenses ÷ Total Expenses

The program expense ratio measures the percentage of expenses a nonprofit organization spends on its core mission. This ratio is critical in the eyes of donors. Charity Navigator updated its rating system in 2023 and now generally gives full credit to those organizations whose ratio of program expenses is 70% or more of their total expenses. However, it’s important to note that this threshold might not apply universally to all organizations or other evaluators. Some organizations with very high program expenses might still face challenges, such as insufficient administrative investment, which can impact long-term sustainability.

- Administrative Expense Ratio

Administrative Expense Ratio = Administrative Expenses ÷ Total Expenses

The administrative expense ratio measures the percentage of an organization’s expenses that are allocated to administrative costs. This nonprofit ratio is often misunderstood. There is an “overhead myth” that organizations shouldn’t spend money on administrative expenses, but this simply would be unsustainable. Organizations need to spend money on overhead to stay competitive and keep up with technology and infrastructure.

- Government Reliance Ratio

Government Reliance Ratio = Government Grants and Contributions ÷ Total Revenue

The government reliance ratio measures a nonprofit organization’s reliance on governmental funding. These sorts of nonprofit ratios are essential when overall levels of government funding are declining. A higher ratio indicates a higher risk for the nonprofit if government funding is reduced or eliminated. Organizations with high ratios should consider diversifying their revenue sources.

- Personnel Expense Ratio

Personnel Expense Ratio = Total Salaries, Wages, and Benefits ÷ Total Revenue

The personnel expense ratio shows how much of the revenue (including donations and grants) is spent on staffing. A high ratio might be appropriate for labor-intensive services but could indicate inefficiency in other types of organizations. For example, an organization that provides counseling services may have a higher ratio than one that provides information and advocacy. If it costs more to generate the same level of revenue, this could be a sign of inefficiencies in operations.

- Fundraising Efficiency Ratio

Fundraising Efficiency Ratio = Total Contributions ÷ Fundraising Expenses

The fundraising efficiency ratio measures the efficiency of an organization’s fundraising activities. Simply put, it measures how much it costs to generate one dollar of charitable contributions. A lower ratio is considered better. Charity Navigator gives full credit to organizations that spend less than $0.20 for every dollar raised. However, context always matters. Some types of fundraising (e.g., events vs. online campaigns) may inherently have different cost structures, and thus the “ideal” ratio can vary.

- Current Ratio

Current Ratio = Current Assets ÷ Current Liabilities

The current ratio is used to measure the overall liquidity of a nonprofit organization. It shows how many dollars of current assets an organization has to cover its current obligations. The higher the ratio, the more liquid the organization. Organizations should strive for a current ratio of 1.0 or higher.

- Cash Reserves Ratio

Cash Reserves Ratio = Unrestricted Cash and Liquid Investments ÷ Average Monthly Expenses

The cash reserves ratio, sometimes referred to as the defensive interval ratio, measures the adequacy of an organization’s resources available to support its mission. This ratio examines how many months of cash are on hand to cover expenses. The recommended range for cash reserves is three to six months.

- Accounts Receivable Turnover Ratio

Accounts Receivable Turnover Ratio = Total Revenue ÷ Average Accounts Receivable

The accounts receivable turnover ratio shows trends in an organization’s account receivable aging. The benchmark depends on the organization’s typical payment terms. If the terms are net 30 days, then you would expect the accounts receivable turnover to be around 12 times per year.

- Leverage Ratio

Leverage Ratio = Total Liabilities ÷ Total Assets

The leverage ratio measures how heavily leveraged an organization is, meaning its reliance on debt. This ratio is also an indicator of how sustainable an organization is. Lower scores are better, with top-rated charities generally having ratios of less than 30%. Increasing trends in this ratio could be a sign of financial trouble.

- Net Margin Ratio

Net Margin Ratio = (Total Revenues – Total Expenses) ÷ Total Revenues

The net margin ratio measures an organization’s ability to operate at a surplus. In simple terms, it shows what is left at the end of the day to reinvest into the organization’s mission. Continued negative trends in this ratio can indicate poor financial management. Nonprofits should be good stewards of any profit generated to ensure sustainability and growth.

Join us in shaping a better tomorrow for Miami County. Your support is more than just a donation. It’s an investment in our community.

A Look at 7 Other Important Nonprofit Metrics

Understanding nonprofit metrics is essential when deciding where to donate. Beyond traditional nonprofit ratios like the government reliance ratio and personnel expense ratio, several key metrics offer deeper insights into a nonprofit’s performance and impact.

So, let’s start with the most popular question: “What is a good fundraising efficiency ratio?” A good fundraising efficiency ratio measures how much a nonprofit spends to raise one dollar, with a lower ratio indicating that a significant portion of funds raised is used efficiently rather than being consumed by fundraising costs.

This ratio is an important indicator of the fundraising process’s financial efficiency, but it should be considered alongside other metrics to assess an organization’s financial health.

Typically, a good fundraising efficiency ratio is around 20% or lower, meaning that no more than 20 cents are spent on fundraising efforts for every dollar raised. However, what constitutes a good ratio can vary depending on the type of nonprofit and its fundraising strategy. For instance, newer or smaller organizations might have higher fundraising costs initially, which could result in a higher efficiency ratio.

It’s important to note that while the fundraising efficiency ratio provides insight into the cost-effectiveness of fundraising, it does not directly measure how much of the total funds are allocated to the nonprofit’s mission. That would be more closely related to the program expense ratio, which examines how much of the total budget is spent on the nonprofit’s programs and services.

Here are seven additional nonprofit metrics that can help you make an informed decision about where to donate:

- Fundraising ROI: Fundraising Return on Investment (ROI) measures how much revenue is generated for every dollar spent on fundraising activities. A higher ROI means the nonprofit is using its resources effectively to generate funds, making your donation more impactful.

- Donor Retention Rate: The donor retention rate shows the percentage of donors who continue to support the organization year after year. A high retention rate indicates strong donor relationships and satisfaction, suggesting that your donation will be part of a sustained effort.

- Donation Growth: Tracking donation growth over time helps you see how well the nonprofit is increasing its donation amounts. Consistent growth can signify successful fundraising efforts and a growing impact. However, the context is key here—growth can be affected by factors such as economic conditions, changes in the organization’s strategy, or even one-time major donations. Therefore, it’s important to look at donation growth alongside other metrics to get a full picture.

- Donor Acquisition Cost: This metric reveals how much it costs the nonprofit to attract a new donor. Lower acquisition costs indicate more efficient use of funds, meaning a larger portion of your donation goes directly to supporting the cause.

- Conversion Rate: The conversion rate measures the percentage of people who take a desired action, such as donating, after engaging with the nonprofit’s content. A high conversion rate suggests effective communication and outreach strategies. However, it should be noted that conversion rates can vary significantly across different platforms (e.g., social media vs. email vs. website), so it’s crucial to analyze this metric in context.

- Gift Frequency: Gift frequency refers to how often donors give to the nonprofit within a certain period. Frequent donations indicate strong donor engagement and a reliable funding stream, enhancing the nonprofit’s ability to plan and execute its programs.

- Email Conversion Rate: The email conversion rate measures the percentage of email recipients who take a specific action, like making a donation. A high email conversion rate shows that the nonprofit’s email campaigns are effective in encouraging support.

- Annual Revenue: Annual revenue represents the total amount of money the nonprofit generates over a year. This metric clearly shows the organization’s financial stability and ability to sustain its operations and programs.

For more detailed information on financial ratios for nonprofits, ANAFP has created a tool featuring 32 different ratios essential for nonprofit organizations. These ratios evaluate several aspects, such as the organization’s dependence on external funding, fundraising effectiveness, mission efficiency, potential surplus generation for future use, and the capacity to finance programs with expendable net assets. Additionally, the tool includes detailed descriptions of the analyses provided by each ratio.

For example, what is a good program expense ratio? A good program expense ratio is one where a large portion of the nonprofit’s expenses is dedicated to its programs rather than administrative or fundraising costs. But you don’t need to analyze all of those by yourself.

Donors can check organizations’ financial ratios on platforms like Charity Navigator, GuideStar, and the Better Business Bureau’s Wise Giving Alliance. These sites provide detailed financial information and ratings that help donors evaluate nonprofits’ financial health and efficiency.

Why Nonprofit Ratios Matter and How To Improve Them

Nonprofit ratios, especially the fundraising efficiency ratio, are crucial gauges in the charitable world. But why fuss over how much it costs to raise a dollar? Efficiency translates into trust. Donors want to know their contributions are hitting the ground running.

At its core, the fundraising efficiency ratio calculates how much a nonprofit spends to bring that dollar in from a donor’s pocket. This includes all fundraising-related expenses, not just those distinct from everyday activities. So, you’re nodding along, thinking, “Alright, tighten the belt, get more money in the door.” But it’s not just about cutting expenses—improving efficiency is also about amplifying effectiveness, ensuring that every dollar spent leads to the best possible outcomes.

How do you ask? Let’s shed some light on tricks:

- First, embrace the fast lane. You’re already a step behind if your fundraising tools move slower than a tortoise on a lazy day. Modern fundraising demands speed. Tools that churn out donor profiles or scan databases in real time can dramatically turn the tables. Why? Because yesterday’s news is no way to plan today’s campaign.

- Second, beware of false positives. Chasing after a donor who seems perfect on paper but is mismatched in reality is hopeful but impractical. Data accuracy is your best friend. With tools sharp enough to distinguish a genuine prospect from a mayfly, you’re not just saving time but making each effort count double.

- Third, don’t just count the coins; consider the heart. Modern tools dig deeper beyond just how thick the wallet is to how likely they are to open it for your cause. Imagine fishing with a net that only catches the fish you can sell, not just any fish in the pond.

- Enter matching gifts. Matching gift programs can double your donations by tapping into existing corporate philanthropy programs. It is about asking smarter.

- Lastly, integration is your new best friend. Marry your fundraising tools with your donor management system. This isn’t just a convenience; it’s a game-changer. Streamlining your process means your team isn’t juggling different platforms but moving in a coordinated dance, from research to relationship building.

Nonprofits, let’s face it, operating like a well-oiled machine isn’t just good practice; it’s a survival tactic. And who doesn’t want to be known as the nonprofit that not only meets but exceeds expectations? Efficiency isn’t just a number—it’s reputation, and as a donor, you need to know that the organization you are donating to is trustworthy.Are you interested in learning more or contributing to our cause? Reach out with any questions you may have. With just one click, you can transform lives. Your donation has the power to create a significant change.